This article appeared in the San Francisco Chronicle on August 12 & was written by their staff writer Carylon Said. http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2007/08/12/BUC5RADBP.DTL

Jamie Schmitt and Valerie Azinheira liked the two-bedroom house in San Francisco’s Merced Heights. It was near a nice park where their 3-year-old son, Gabriel, could play. They made a no-contingency offer for the full $629,000 listing price on June 20.

Then they waited. And waited. And, well, waited some more.

It took a full five weeks to find out whether their offer was accepted. (It was.)

The offer “just fell into the abyss,” said Schmitt, 38, a handyman/remodeler who also lends his expertise to several fix-it shows on the Home & Garden TV Network.

That’s because the couple was buying in what’s called a “short sale,” in which a house sells for less than – or “short” of – what is owed on the mortgage. Almost unknown for the past two decades, short sales are making a comeback as a way out for cash-strapped homeowners who can’t keep up on their mortgage payments.

Ordinarily the person selling a home gets to decide on offers. But in a short sale, the mortgage holder holds all the cards. Because that lender will be taking a loss, it may choose to turn down short-sale offers, and instead allow a property to go through foreclosure.

Even though Schmitt and Azinheira paid the full asking price on their home, the previous owner owed $685,000 on the mortgage – and had spent heavily on rehabbing the house. The owner originally listed the house for $720,000, but in the softening market, had to keep dropping the price to less than she owed.

Buying from a gargantuan financial institution means numerous roadblocks.

“It was like the seller wasn’t even there,” Schmitt said. “They were being pushed off to one side, and this big bank was coming in and being the seller.”

Stuart Wilson, an agent with Paragon Real Estate Group, who represented the couple, said he finally galvanized a decision by telling the listing agent that his buyers had lost confidence the sale would close and planned to withdraw from the contract if they didn’t get lender approval by July 25. “That did the trick,” he said. “We got approval that day.”

A prior buyer had grown impatient with the protracted wait and bailed.

Wilson agreed that it is frustrating dealing with lenders in short sales.

“The lenders (seem) not prepared to act in a timely, resolved and professional fashion on a short sale,” he said. “They just don’t get it that they have to get rid of this property, that every day they have it costs them more money. They are overloaded, overburdened, confused, unable to deal.”

Schmitt and Azinheira have a month-to-month rental so they could wait for a decision. But for buyers who need to move quickly, such as people who just sold a home, a short sale would be more difficult.

Two increasingly common factors converge to create the circumstances for a short sale:

— Homeowners have no equity or negative equity. Generally that’s because they bought with 100 percent financing (or took out extra loans after buying) and the house is worth less than they paid for it.

— The homeowner can’t make the payments. These days that’s probably because an adjustable-rate mortgage has reset at a higher rate, perhaps adding hundreds of dollars onto the monthly payment. In the first half of this year, lenders sent 14,426 notices of default to Bay Area homeowners for missing mortgage payments, according to DataQuick Information Services. An untold additional number may be scraping to make payments but eventually will fall behind.

For beleaguered homeowners, a short sale is better for their credit rating than going through a foreclosure. Still, they may end up owing extra taxes on the deal. In many cases, if you owe $600,000 on your mortgage and the lender allows a short sale for $500,000, the IRS expects you to pay taxes as if you “earned” the $100,000 forgiven on the loan. Legislation is pending in Congress that could change that rule.

For buyers, short sales may yield some bargains, albeit minor ones. Banks are not in the business of giving away money, so they want to be assured that short-sale properties are going for their true market value. Still, short-sale properties are priced to move. And they do have the advantage of weeding out competing buyers who don’t have the stamina to go through the process.

For banks, short sales represent a way to cut their losses on a soured mortgage more quickly than going through the protracted foreclosure process. But that doesn’t mean banks are enthusiastic about short sales – or even familiar with them.

“Eleven years ago when I got my license, we were in a market similar to now and short sales were more common,” said Janice Spencer, a broker-owner of Windermere Signature Collection in Antioch. “Banks would preapprove them. Now it’s been so long that we’ve had such a good market, banks are not set up to deal with them. The longer we’re in this (soft) market, banks will realize they have to step up to the plate.”

The listing agents for short-sale properties are required to disclose that the homes are being sold “subject to lender approval” or that they are a short sale. That information generally shows up only in parts of the MLS reserved for real estate agents, such as the “confidential remarks” section or the line for “special assessments and other disclosures,” Spencer said. Less often, it may be in the “public remarks” section that consumers can view.

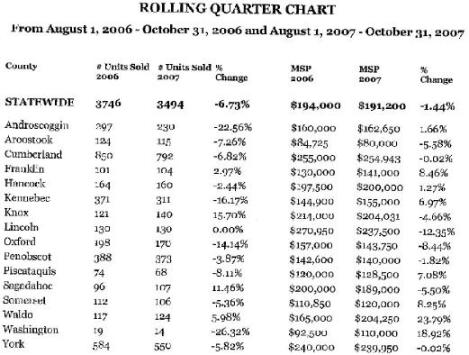

Spencer said about a third to a half of the homes for sale in her area of Antioch, Oakley, Brentwood, Discovery Bay, Pittsburg and Bay Point are short sales or foreclosures. She has represented buyers who made offers on short-sale properties only to walk away when they could not get a response from the lender.

Why are lenders reluctant to agree to short sales?

“Lenders and mortgage servicers consider (short sales) a necessary evil, but it obviously involves a loss for them,” said Guy Cecala, publisher of Inside Mortgage Finance, a newsletter in Bethesda, Md.

The biggest stumbling block, Cecala said, is that two-thirds of all mortgages in the United States are owned by Wall Street investors. The banks that “service” loans – collecting the mortgage payments – cannot decide about short sales. That adds in a layer of complexity.

Banking giant Chase services $500 billion of home mortgages for other institutions. Chase spokesman Tom Kelly said Chase seeks approval from the investors who own a mortgage when a short sale is requested. It takes 45 to 60 days to get a decision, and each investor has separate rules about how it handles short sales, he said.

One key consideration is making sure a short-sale home is going for fair market value, as determined by an independent appraiser.

“We want to make sure the person isn’t selling to someone they know” in a sweetheart deal, Kelly said. “We are protecting the investor who owns the loans.”

Jay Brinkmann, vice president of research and economics at the Mortgage Bankers Association in Washington, echoed that concern.

“You have to watch to make sure (the seller) isn’t cutting their brother-in-law a deal,” he said.

Brinkmann said another consideration for lenders is how far along a house is in the multi-month foreclosure process.

Foreclosures cost banks easily $30,000 to $40,000, including the missed mortgage payments, fix-up costs for neglected property, legal and filing fees, and various carrying costs, he said.

“If the bank has already incurred most of the expenses and is ready to foreclose anyway, it will say, ‘We’re not going to save anything here (with a short sale),’ ” Brinkmann said.

Terry Baldwin, a Realtor with Zip Realty specializing in the East Bay, has represented the buyer in five different short-sale deals. He said he’s seen it take as long as 16 weeks to get an answer from the bank.

Baldwin advises his clients in short sales not to expect that a lowball offer will get results.

“As a buyer, I think you can get a fair price going with the asking price,” he said. “Bankers do not really want to have the property; they want to have a fair price.” In fact, he said there is less room for negotiation in a short sale, because the seller is “a person in another state with paperwork 1 foot thick.”

Systems engineer Scott Werntz, 39, is house hunting now in Antioch and Brentwood, working with Baldwin. He would be happy if a short sale or foreclosure meant that he got a better deal.

Werntz said he’s seen prices fall dramatically since he started looking in January.

“There are so many (houses for sale), and it’s slowed so much, that I think I’m safe purchasing something now,” he said. “While I feel bad for the people who are losing their houses, I also have to look out for No. 1 and do what I have to do to find a place for myself and my son.”

The new stimulus bill is being signed into effect today with some great benefits for you, the “first time” home buyer.

The new stimulus bill is being signed into effect today with some great benefits for you, the “first time” home buyer.